Travel and expense (T&E) management is the system for handling costs incurred during business activities. For any professional, this is about more than reimbursement for a flight or a client lunch. It is about establishing a reliable system that ensures accurate reimbursement, simplifies tax preparation, and provides a clear overview of business expenditure.

Moving Beyond the Shoebox of Receipts

The traditional method—stuffing crumpled receipts into an envelope or shoebox—is inefficient. Whether you are a consultant at a major firm, a sales representative on the road, or a freelancer managing your own finances, the administrative burden of paper-based expense tracking is a significant drain on time.

Common frustrations include the Friday afternoon search for a specific receipt, the difficulty recalling the details of a dinner from three weeks prior, or the back-and-forth email exchange with accounting over missing documentation. For professionals working across borders in the UK, Japan, or the DACH region, the complexity increases with multiple currencies and varied VAT regulations.

The True Cost of Inefficiency

The consequences of a disorganised expense system extend beyond wasted hours.

A lost receipt for a client dinner is a direct financial loss. A faded thermal paper invoice for fuel means you cannot reclaim the VAT. For professionals in regulated industries like law or architecture, where every cost must be meticulously documented for client billing, poor records can lead to serious compliance issues.

These small problems accumulate, creating operational friction that reduces productivity and can negatively impact the financial health of a business.

For a busy professional, every minute spent on administration is a minute not spent on billable client work. A digital-first approach to T&E is a direct investment in personal and business efficiency.

The Growing Need for Digital Solutions

The importance of efficient T&E management is increasing as business travel returns. Global business travel spending is forecast to reach $1.57 trillion in 2025, a 6.6% increase from the $1.48 trillion projected for 2024. You can discover more insights about this travel spending forecast.

This growth translates to more flights, hotel stays, and receipts to manage. A larger shoebox is not the solution.

Adopting a modern, automated system transforms expense tracking from a reactive chore into a proactive habit. It replaces administrative chaos with a clean, organised, and compliant digital record, establishing a foundation for effective financial control.

The Real-World Problems of Managing Business Expenses

Poorly managed travel and expenses are more than a minor annoyance; they represent a tangible financial and operational risk. The problem often starts with a single crumpled taxi receipt or a hastily submitted report, but these issues compound, creating significant problems for businesses and independent professionals.

The most direct pain point is lost money. Every misplaced receipt is a reimbursement that cannot be claimed. Every faded thermal slip is a business expense that cannot be documented. For freelancers and small business owners in Europe, this often results in missed VAT deductions simply because the required paperwork is not in order.

Then there is the operational drag. Consider the hours wasted on manual data entry from receipts, deciphering vague credit card statements, or chasing colleagues for a missing invoice. This is particularly inefficient for personal assistants at consulting firms like McKinsey or Deloitte, whose time could be allocated to higher-value tasks than assembling a consultant's expense report.

The Tangible Costs of Disorganised Expenses

With business travel increasing, the financial stakes are higher. Average flight prices in the USA and Canada are expected to rise from $668 in 2023 to $701 in 2024. Simultaneously, global hotel rates have climbed 2.5% to an average of $162 per night. For consultants travelling between continents or small business owners funding their own trips, meticulous expense tracking is no longer optional—it is essential. You can review the latest trends in business travel costs for a comprehensive overview.

These rising costs amplify the negative consequences of an inadequate expense process:

- Inaccurate Project Costing: When a project manager cannot allocate a specific lunch or hotel stay to a client project, billing becomes inaccurate. This leads to either under-charging the client or absorbing costs that should have been passed on, both of which erode profit margins.

- Protracted Accounting Cycles: The Friday afternoon email chain with the finance department is a familiar problem. A single missing detail on one report can delay the entire reimbursement batch, wasting time for all involved.

- Compliance and Audit Risks: For professionals in regulated sectors such as law or pharmaceuticals, incomplete records are a significant compliance risk. In the DACH region (Germany, Austria, Switzerland), failure to comply with strict digital archiving rules (GoBD) can lead to substantial penalties during a tax audit.

An expense management process is not merely an internal procedure; it is a direct indicator of a business's financial discipline. A shoebox of receipts suggests chaos, whereas a clean digital trail signals control and foresight.

From Manual Effort to Automated Precision

Comparing a manual process with a modern, automated approach reveals a stark contrast. Large enterprise systems like SAP Concur or Spendesk offer comprehensive solutions for corporate procurement. However, for individuals and small teams, the challenge is simpler: how to capture expense data accurately at the source, without unnecessary complexity.

The table below outlines the common frustrations of manual expense tracking against the solutions provided by modern tools.

Manual vs. Automated Expense Management: Key Pain Points

| Challenge | Manual Process (The Problem) | Automated Solution (The Fix) |

|---|---|---|

| Receipt Capture | Receipts are stuffed in a wallet, becoming lost, faded, or damaged before processing. | A mobile app like Bill.Dock allows instant receipt scanning with 95%+ accuracy, creating a permanent digital copy on the spot. |

| Data Entry | Hours are spent manually typing merchant names, dates, amounts, and VAT into spreadsheets. | AI-powered scanning extracts all necessary data automatically, eliminating manual work and human error. |

| Multi-Currency | Expenses from trips to London, Tokyo, or Singapore require manual currency conversion, a tedious and error-prone task. | The system automatically recognises and converts over 150 currencies to your home currency for clear, accurate reporting. |

| Compliance | Storing paper receipts is insecure and often fails to meet digital archiving regulations like GoBD in Germany. | Receipts are stored on secure, GDPR-compliant EU servers (in Frankfurt), creating an audit-ready digital archive. |

The objective is to shift from a reactive, time-consuming process to a proactive, efficient one, allowing more time to be spent on core business activities rather than on paperwork.

Building a Practical T&E Management Framework

Effective travel and expense management does not require complex corporate bureaucracy. For individuals and small teams, it is about creating a simple, repeatable system that saves time, ensures prompt reimbursement, and maintains immaculate financial records. A solid framework rests on four pillars: policy, capture, approval, and reporting.

If the policy is unclear, the entire system is unstable. If expense capture is inefficient, money is lost. A slow approval process creates bottlenecks, and without proper reporting, you lack financial visibility. Each component must function in concert to create a system that is both effective and low-stress.

Establish a Clear Expense Policy

First, define the rules. A travel and expense policy does not need to be a lengthy document; it must be clear, fair, and easily accessible.

For a freelancer, this means defining your own rules for what constitutes a legitimate business expense. For a small business, it ensures the team understands expectations.

Your policy should address these fundamental questions:

- What is reimbursable? Clearly define categories such as flights, hotels, client meals, and local transport.

- Are there spending limits? Establish reasonable per diems or caps on hotel rates to manage costs.

- What documentation is required? Specify that an itemised receipt is mandatory for every claim.

A well-defined policy eliminates ambiguity. It ensures every expense report is compliant, which is the best defence against rejected claims and tax season complications. For further guidance, see our article on how to create an effective travel and expense policy.

Prioritise Immediate Receipt Capture

The most significant point of failure in any manual expense process is the delay between a transaction and its documentation. A paper receipt is a temporary record, susceptible to being lost, damaged, or fading to illegibility. The core of modern travel and expense management is capturing this information at the moment of the transaction.

This is where mobile-first tools are indispensable. Instead of collecting paper receipts, adopt a new habit: after a purchase, take a photo of the receipt and let the software handle the data entry. AI-powered tools like Bill.Dock can extract the vendor, date, total, and tax information with over 95% accuracy in seconds.

This simple action transforms a disorganised paper chase into a clean, real-time digital record.

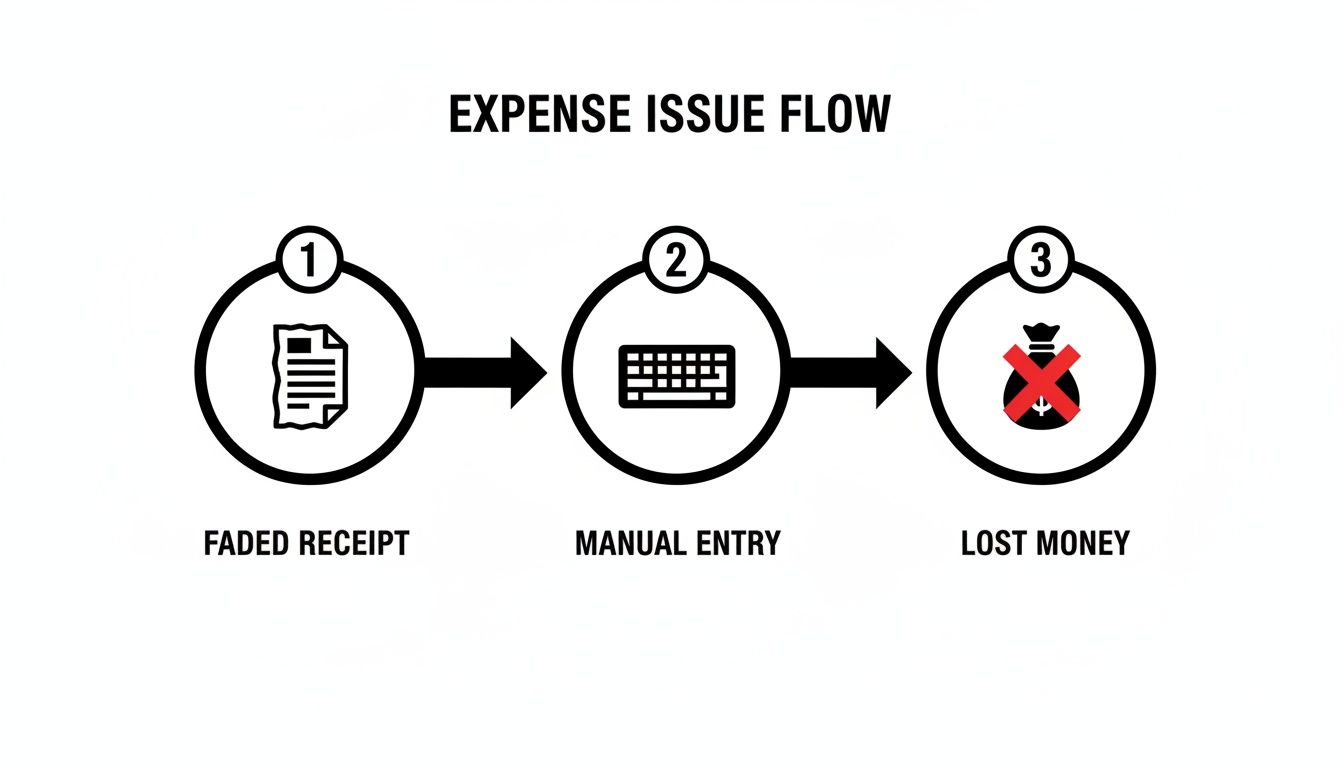

The diagram below illustrates the breakdown of the traditional manual process. A faded receipt leads to frustrating manual data entry, which often results in errors and, ultimately, financial loss.

This highlights the direct financial cost of outdated methods—a problem that immediate digital capture resolves.

Define the Approval and Reimbursement Workflow

Once an expense is captured, the next step is approval and reimbursement. A clear, predictable workflow is essential to avoid delays and maintain satisfaction.

For a self-employed professional, "approval" may simply mean reviewing and finalising your own records. For those with an assistant or accountant, it involves a defined hand-off.

An ideal workflow is straightforward:

- Submission: The expense is captured on-the-go using a mobile or web app.

- Review: The designated approver—a manager, accountant, or personal assistant—receives a notification.

- Approval: The expense is approved with a single click.

- Reimbursement: The approved amount is added to the next payment cycle.

Features like delegate access are particularly useful. A busy consultant or lawyer can grant their personal assistant secure access to their expense account. The assistant can then organise receipts and prepare reports without needing to share login credentials.

Leverage Data for Reporting and Analysis

The final pillar involves converting raw expense data into actionable insights. This is where a digital system demonstrates its true value. Instead of a shoebox of paper, you have structured data that can answer critical financial questions.

This data-driven approach is becoming standard. A recent study of over 7,300 global travellers found that 67% already use dedicated expense systems. Meanwhile, corporate card access has reached 69%, and mobile wallet usage has risen to 64%. The shift towards automated platforms is clear, whether for a sole proprietor or a consultant at a major firm.

With a digital system, you can instantly filter expenses by project to assess budget adherence. You can analyse spending by category to identify cost-saving opportunities. You can export a complete, tax-ready report in seconds. This is not just about reimbursement; it is about taking full control of your business finances.

How to Select the Right Expense Management Tool

Choosing the right tool for travel and expense management is not about finding a single solution for everyone, but the one that fits your specific needs. The market is populated with options that fall into distinct categories, each designed for a different user. The goal is to find software that solves your primary problems without introducing new ones.

At one end are enterprise-level systems like SAP Concur or Spendesk. These are powerful, all-in-one platforms built for large corporations, designed to manage thousands of employees and integrate with complex procurement, HR, and accounting systems. For a large company, they are essential. For a freelancer or small business, they are often overly complex and costly.

At the other end are specialised, mobile-first tools designed for individuals and small teams. Solutions like Bill.Dock, N2F, Circula, or Rydoo focus on the core issues: capturing receipts and ensuring data accuracy. They are built for speed and simplicity. If you are a professional who needs to quickly photograph a receipt and move on—not navigate a complicated corporate approval workflow—this category is the most suitable.

Creating Your Evaluation Checklist

To find the best fit, create a clear checklist. Focus on the practical, day-to-day functions that will save you time and money, and solve your real-world frustrations.

A solid evaluation framework should include:

- Accuracy of Data Extraction: How reliably does the tool read a receipt? A high accuracy rate—95% or higher—is non-negotiable. Otherwise, you are merely trading manual data entry for manual error correction.

- Multi-Currency Support: For international travel, this is essential. The software must automatically recognise different currencies (USD, GBP, JPY, CHF, etc.) and convert them to your home currency. Bill.Dock supports over 150 currencies.

- Delegate Access: Can you grant your accountant or assistant access without sharing your password? This feature is crucial for busy professionals who delegate administrative tasks, allowing a trusted colleague to organise receipts and prepare reports securely.

- Data Security and Compliance: Where is your financial data stored? For professionals in Europe, a tool with EU-based servers (e.g., in Frankfurt) that is fully GDPR compliant is critical for data protection.

- Export and Integration Capabilities: Getting data out of the tool is as important as getting it in. Look for flexible export options like Excel, CSV, and PDF. A DATEV-compatible export is a major time-saver for tax advisors in the DACH region. Reviewing a guide on the best expense management software can provide useful comparisons.

Expense Management Tool Comparison for Different User Needs

To clarify, here is a breakdown of the major tool categories. Consider where you fit and what your core needs are.

| Tool Category | Example Tools | Ideal User Profile | Core Strength |

|---|---|---|---|

| Enterprise Suites | SAP Concur, Spendesk | Large corporations (1,000+ employees) | Deep integration with ERP, HR, and procurement systems. |

| SMB Platforms | Expensify, Lexware | Small to mid-sized businesses (50-500 employees) | Balances robust features with user-friendly interfaces. |

| Mobile-First Scanners | Bill.Dock, N2F | Freelancers, consultants, small teams (1-20 employees) | Speed, simplicity, and highly accurate mobile capture. |

| Accounting Add-ons | QuickBooks Online, Xero | Businesses already using the accounting platform. | Seamless integration within a single financial ecosystem. |

The "best" tool depends on the user. The key is to align the tool's core strength with your business reality.

Matching the Tool to Your Reality

Ultimately, you must be realistic about your actual requirements. A self-employed architect in Berlin has different needs than a 5,000-person company. They do not require procurement workflows; they need a fast, reliable way to convert a paper receipt from a taxi in Singapore into a clean digital record for their tax advisor.

The screenshot below shows a dashboard designed for this purpose—it prioritises clarity and provides immediate access to spending data.

This interface focuses on simplicity, displaying total expenses at a glance and enabling quick filtering. It is far removed from the dense, menu-heavy interfaces of enterprise software. This design is ideal for individuals and small teams who value efficiency. If this aligns with your needs, our guide on paperless accounting software offers more practical advice.

The best tool is one that integrates seamlessly into your daily routine. It should make capturing an expense as effortless as taking a photo, not add another complex piece of software to manage.

Choosing the right software involves a trade-off between power and usability. By focusing on your specific pain points—such as lost receipts, multi-currency complexity, or difficult collaboration with your accountant—you can select a tool that genuinely improves your workflow.

Best Practices for Daily Expense Capture

No one enjoys sorting through a pile of crumpled receipts at the end of the month. The key to effective expense management is not bookkeeping expertise, but transforming a dreaded task into a series of small, two-minute actions.

The foundation is a consistent ‘capture habit’—processing each expense as it occurs. This simple shift prevents receipts from accumulating and eliminates the difficulty of recalling details weeks later. Your wallet and inbox are constant sources of potential deductions, and with the right approach, each can be processed instantly.

This is not about adding another chore, but about using technology to make the process so quick it becomes second nature.

The Immediate Capture Habit

The single most important practice is to digitise receipts on the spot. Do not wait until you return to the hotel or office.

- At the Point of Sale: After paying for a client coffee or a taxi, use your phone to scan the receipt with an app like Bill.Dock before putting your wallet away. AI extracts the data with 95%+ accuracy, much faster than manual entry.

- For Digital Invoices: When a flight confirmation or software subscription arrives in your inbox, forward it to your dedicated expense management email address. This creates a digital record without needing to download a PDF or take a screenshot.

This habit ensures nothing is lost. A receipt for a business lunch in London or a train ticket in Tokyo is captured with equal ease, preserving all details while they are fresh. This is also the ideal moment to add context, such as assigning the expense to a specific client project or noting attendees.

Handling Complexity with Ease

Business expenses are often complex, involving multiple currencies, shared costs, and specific tax rules. A good daily capture process must handle this without causing delays.

For international travellers, manually converting currencies like JPY, GBP, or CHF is tedious and prone to error. A capable tool handles this automatically, recognising over 150 currencies and converting them to your home currency for consistent reporting.

Similarly, for a split expense—such as a dinner that is only partially business-related—the split should be manageable directly in the app at the time of capture, eliminating guesswork later. For more on the fundamentals, our guide on how to properly organise receipts is a useful resource.

Categorisation for Tax and VAT Compliance

The final element is accurate categorisation. This is not just for organised bookkeeping; it is critical for maximising tax deductions and ensuring correct VAT recovery, a significant consideration for anyone doing business in Europe.

When you scan a receipt, assign it to the correct category immediately—"Travel," "Meals & Entertainment," "Office Supplies." This simple action keeps your financial data structured and ready for reporting. Beyond taking a photo, it is vital to know how to properly categorize business expenses to simplify budgeting and reconciliation.

By making immediate capture and categorisation a habit, you transform expense management from a reactive, stressful event into a proactive, continuous process. It is the difference between control and chaos.

With this disciplined approach, when it is time to file a report or prepare for tax season, the work is already 99% complete. All that remains is to export the clean, organised data.

How Do You Know If Your T&E System is Actually Working?

After implementing a new travel and expense system, how can you measure its effectiveness? Success is measured through a combination of quantifiable financial gains and valuable, less tangible improvements. When the cost savings from a dedicated tool exceed its subscription fee, the investment is easily justified.

The most immediate benefit is the time saved on administrative tasks. Manual expense reporting is a significant time commitment. Automating receipt capture, data entry, and report generation frees up hours each month. For a consultant or lawyer, this means more billable time. For a small business owner, it means more time for strategic planning instead of managing paperwork.

The Key Numbers to Track

To quantify the benefits, focus on these core metrics. They provide a solid financial case for adopting a modern expense management tool.

- Higher VAT Recovery: For business conducted in Europe or the UK, every receipt with VAT represents a potential refund. Automated systems excel at capturing this data accurately, preventing financial loss due to faded receipts or data entry errors. This single metric can often cover the software's cost.

- Fewer Out-of-Pocket Losses: A lost receipt is a direct financial loss. A system that allows you to photograph a receipt at the moment of transaction eliminates this problem. 100% of legitimate expenses are documented and ready for reimbursement or tax deductions.

- The Value of Your Time: This is a simple but powerful calculation. Multiply the hours saved each month by an individual's hourly rate. For example, if a professional who bills at €100/hour saves just three hours a month, that equates to a €300 monthly saving. This represents a substantial return on an annual subscription of €59 or €99.

The objective is not merely to track expenditure. It is to turn expense data into a tool for smarter business management. An effective T&E system pays for itself by preventing financial leaks and, more importantly, freeing up your time.

The Qualitative Wins That Make a Big Difference

While harder to quantify, the qualitative benefits of a good T&E system are equally important. These improvements reduce friction and stress, allowing everyone to focus on their primary responsibilities.

One of the most significant benefits is smoother collaboration with your accountant or assistant. Providing your tax advisor with a clean, organised digital export from a tool like Bill.Dock instead of a shoebox of receipts drastically reduces their workload and your bill. Features like delegate access allow a personal assistant to securely manage expenses for a busy consultant, removing a significant administrative burden.

The result is less stress before tax deadlines, a clearer view of project profitability, and a more professional approach to financial management. You shift from reacting to paperwork to proactively using financial data to make better decisions.

Frequently Asked Questions About T&E

Practical questions often arise when managing travel and expenses. Here are answers to some of the most common queries from professionals, aimed at keeping your process simple, compliant, and efficient.

How Long Should I Keep Business Receipts in Europe?

The rules for record retention vary across Europe. There is no single standard, but a general guideline is to retain financial documents for between six and ten years.

In Germany, Austria, and Switzerland (the DACH region), the regulations are particularly stringent. Germany’s GoBD regulations, for instance, require that most tax-related documents, including all receipts and invoices, be kept for a full 10 years. Digital copies are permissible, provided the storage system is tamper-proof and secure. Using a tool that archives your data on EU-based servers helps ensure compliance.

What’s the Best Way to Handle Expenses in Different Currencies?

The most practical way to manage multi-currency expenses is with a tool that provides automatic, real-time conversions. Manually looking up exchange rates for transactions in GBP (London), JPY (Tokyo), or CHF (Zurich) is inefficient and error-prone.

A robust expense management platform handles this automatically. When you scan a receipt, the system should recognise the foreign currency—ideally supporting 150+ currencies—and convert it to your home currency (e.g., EUR, USD, or AUD). This ensures all reports are consistent and accurate, removing the guesswork from international travel.

How Can I Give My Assistant Access to My Expenses Without Sharing My Password?

The most secure and professional method is to use a delegate access feature. This is a standard function in modern expense tools designed for busy professionals, such as consultants at firms like BCG or Accenture who rely on their assistants.

Instead of sharing your password, which is a significant security risk, you grant a trusted colleague limited, secure access to your account. Your PA or accountant can then view, organise, and export receipts on your behalf. You retain full control and can revoke access at any time, making it a secure and collaborative solution.

Is a Photo of a Receipt Sufficient for the Tax Office?

In most jurisdictions, yes, a high-quality digital copy of a receipt is as valid as the paper original, provided it meets certain standards for compliant digital document retention.

For instance, regulations like Germany's GoBD permit the replacement of paper originals with digital scans, but only if the process ensures the file is unalterable. The digital version must be a perfect, tamper-proof copy of the original. Using a professional scanning tool is the best way to ensure your digital records will withstand audit scrutiny.

Ready to eliminate the administrative burden of expense management? Bill.Dock uses AI to scan your receipts with 95%+ accuracy, offers secure delegate access, and handles over 150 currencies to give you your time back. The Starter plan is €59/year. Start your free 30-day trial today at Bill.Dock. No credit card required.