A travel and expense (T&E) policy is a set of guidelines defining how company money is spent on business activities and the exact process for reimbursement. For any business, this document is critical for controlling costs, ensuring tax compliance (especially for VAT), and preventing fraud. For employees and freelancers, it removes the guesswork from spending.

Why a Travel and Expense Policy Is Non-Negotiable

Operating without a formal T&E policy creates inefficiency, risk, and expensive mistakes. It establishes a grey area where employees guess what is permissible, leading to inconsistent spending, reimbursement disputes, and friction between teams. The Friday afternoon back-and-forth with accounting over a missing receipt becomes a recurring, time-wasting event.

For professionals who travel frequently, such as management consultants or sales representatives, unclear rules lead to wasted time and personal financial strain. Every minute spent clarifying whether a client dinner is a valid expense or chasing a reimbursement is a minute not spent on core responsibilities. For freelancers and small business owners, ambiguous rules make tax season a significant challenge, often resulting in a shoebox of faded receipts for the tax advisor and missed VAT deductions.

The Real Cost of Vague Guidelines

The problems caused by a weak or non-existent policy extend beyond simple confusion. They create tangible issues that impact the bottom line and employee morale.

- Financial Inefficiency: Without defined spending limits and preferred vendors, costs can escalate before they are noticed.

- Compliance Risks: In jurisdictions like the DACH region, the UK, or Australia, poor documentation can lead to failed audits and financial penalties, particularly regarding VAT claims.

- Administrative Burden: Accounting teams become trapped in a cycle of clarifying rules and chasing missing receipts from faded thermal paper. This slows down the entire process, causing delayed reimbursements and dissatisfied employees.

- Unfairness and Inconsistency: When rules are not documented, reimbursement decisions can seem arbitrary, fostering a sense of unfairness.

A well-structured T&E policy serves multiple functions, creating clear benefits for both the company and its employees.

Key Objectives of a Travel and Expense Policy

| Objective | Benefit for the Company | Benefit for the Employee |

|---|---|---|

| Cost Control | Sets clear spending limits and promotes the use of cost-effective vendors, reducing waste. | Provides clear budget expectations, eliminating guesswork and financial stress during travel. |

| Compliance & Risk | Ensures adherence to tax laws (e.g., VAT) and internal rules, protecting against fraud. | Guarantees that expenses submitted according to policy will be approved and reimbursed. |

| Operational Clarity | Standardises the expense reporting process, making it predictable and efficient for everyone. | Simplifies the reimbursement process, ensuring timely payment for out-of-pocket costs. |

| Fairness & Equity | Applies the same rules to all employees, preventing favouritism or inconsistent decisions. | Creates a level playing field where everyone understands their entitlements and obligations. |

Ultimately, the policy acts as a framework that protects the company's financial health while ensuring employees are treated fairly for the business expenses they incur.

Balancing Cost Control with Business Needs

In the current economic climate, achieving this balance is critical. While global business travel spending is projected to reach $1.64 trillion, companies are also implementing stricter cost controls. A recent report found that 60% of business travellers experience these budget cuts through stricter policies, such as mandatory economy-class flights or no checked baggage allowances. You can discover more insights about business travel statistics and see how companies are adapting.

A well-defined travel and expense policy serves as a foundational agreement between an organisation and its people. It clarifies responsibilities, protects the company from unnecessary risk, and ensures that employees are treated fairly and reimbursed promptly for legitimate business costs. It’s an essential tool for operational clarity, not just corporate bureaucracy.

What Goes Into a Strong T&E Policy?

An effective travel and expense policy should function as a practical guide, not a restrictive rulebook. Its purpose is to provide clear, simple answers to common questions before they are asked, preventing the common end-of-week scramble between a traveller and the finance team. To be effective, it must be built on clear, understandable pillars.

Omitting any of these key components creates grey areas where confusion, inconsistent approvals, and budget surprises thrive. A truly effective policy is thorough and leaves no room for interpretation.

Travel Booking Procedures

This section outlines the "how" and "where" of booking business trips. A consistent process is the most effective way to manage costs and centralise travel data. Ambiguous booking instructions are a primary cause of uncontrolled spending.

Your policy must specify:

- Approved Booking Channels: Clarify whether employees must use a specific travel management company (TMC), a corporate booking tool like SAP Concur or Spendesk, or if they are permitted to book directly with suppliers.

- Pre-Approval Requirements: Detail which expenses require a manager's approval before purchase. This typically includes all flights, multi-night hotel stays, and any single expense exceeding a set threshold (e.g., £500).

- Payment Methods: State whether employees should use a corporate credit card or pay personally for later reimbursement.

Expense Categories and Spending Limits

This is the core of your policy, defining what the company will pay for and establishing firm spending limits. Vagueness here is expensive; one person's definition of a "reasonable" hotel can differ significantly from the company’s budget.

A policy's real power is in the details. Don't just say "book economy flights." A much better rule is, "All flights under six hours must be booked in economy class." That one sentence clears up ambiguity and keeps things fair for everyone.

Define these key categories:

- Air Travel: Specify the allowed fare class (e.g., Economy, or Premium Economy for long-haul flights). Also, outline rules for ancillary fees like seat selection and checked baggage.

- Accommodation: Set a clear per-night cap for hotel rooms, adjusted by city. For example, you might set a €200/night limit for Berlin but allow up to €350/night in Zurich.

- Ground Transportation: Define the rules for taxis, ride-sharing services, public transport, and rental cars. For rentals, specify the approved vehicle class.

- Meals: You have two primary options: a per diem (a fixed daily allowance) or reimbursement for actual costs based on itemised receipts. Per diems are simpler to administer, while actuals provide greater control over spending.

Entertainment and Non-Reimbursable Expenses

Defining what the company will not pay for is as important as listing what it will. This section establishes clear boundaries to prevent personal items from appearing on an expense report, protecting both employees and the business.

Create a straightforward list of excluded items.

Common Exclusions:

- Airline or hotel upgrades that were not pre-approved

- Mini-bar charges and in-room movies

- Gym passes, spa treatments, or other personal wellness services

- Traffic tickets or parking fines

- Childcare costs

- Clothing, toiletries, or other personal grooming items

For client entertainment, the policy must require documentation of attendees and the business purpose of the meeting. This is essential for tax compliance, particularly for VAT deductions in Europe where an auditor could reject the expense without such details. Establishing these rules ensures that every professional, from a consultant at Deloitte to a self-employed architect, understands how to spend responsibly.

Creating a Clear Expense Reporting and Reimbursement Process

A strong travel and expense policy is only effective if the submission and payment process is simple and predictable. A cumbersome workflow becomes a source of frustration, leading to late submissions, rejected reports, and wasted time for everyone involved.

Clarity is paramount. Your employees, freelancers, and consultants need to know exactly what is expected, from submission deadlines to the requirements for a valid receipt. This eliminates guesswork and the back-and-forth with finance over minor issues.

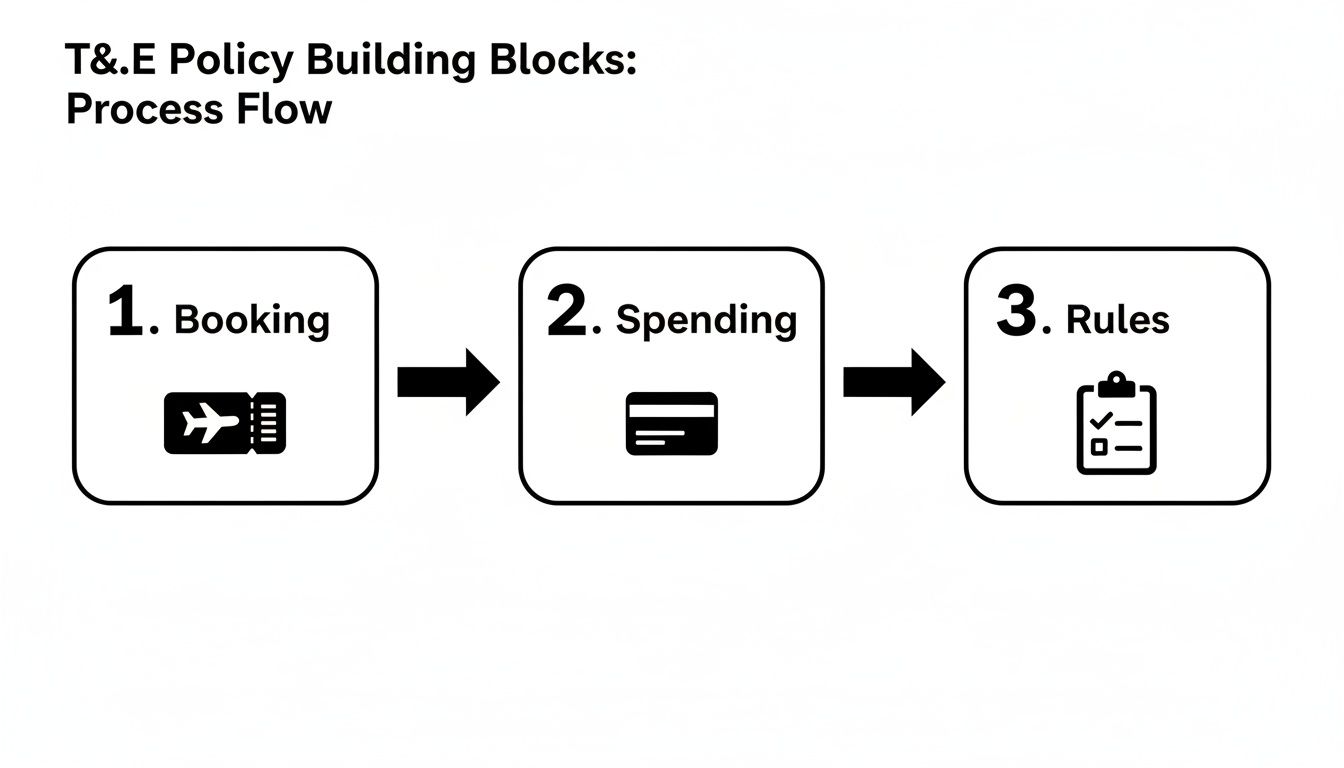

The process can be broken down into three parts: booking travel, incurring expenses, and applying the rules.

Each step requires clear guidelines to ensure a smooth and efficient experience for the traveller.

Establishing the Ground Rules for Submission

First, set firm but fair deadlines. A common standard is requiring all expense reports to be submitted within 30 days of the trip's end or the expense date. This rule helps ensure costs are recorded in the correct accounting period and prevents a chaotic rush at the end of a quarter.

Next, define your documentation standards. The era of storing a shoebox full of faded thermal receipts is over. A modern policy should require:

- Digital Receipts: Clear scans or photos of original, itemised receipts are essential.

- Proof of Payment: A credit card statement or confirmation email may be needed to verify the transaction.

- Business Purpose: Every expense requires a brief but clear note explaining its business context.

For freelancers and self-employed professionals, particularly in the UK or DACH countries, maintaining these records is non-negotiable for accurate tax filing and VAT deductions. A lost or illegible receipt translates directly into lost money. This is why implementing good small business expense tracking tips is a cornerstone of any effective T&E policy.

The Approval Chain and Reimbursement Timeline

A transparent approval workflow is critical. Your policy should clearly map out who must review and approve reports. Typically, this involves the employee’s direct manager, followed by a final check from the finance team. This two-step process provides robust oversight without creating unnecessary bureaucracy.

Equally important is a firm commitment to a reimbursement timeline. A good practice is to process and pay approved reports within 5-10 business days. Delayed reimbursements place a financial burden on employees who used personal funds, which can quickly erode morale and trust.

Moving Beyond Manual Processes

Manual methods like spreadsheets and emailed scans are slow and prone to error. A cumbersome process is a primary reason why employees avoid company systems. Research indicates that only 18% of business travellers consistently use their company's designated booking platform, often citing difficult submission processes.

The goal of an expense process isn't to catch people out; it's to make reimbursement simple, fast, and compliant. If the process is more painful than the travel itself, it’s broken.

Tools like Bill.Dock are designed to solve this exact problem. Instead of manual data entry, a user takes a photo of a receipt. The software’s AI extracts all key information—vendor, date, amount, VAT, currency—with over 95% accuracy. This eliminates the need for manual typing and significantly reduces the time spent on each report.

For a consultant at a firm like McKinsey or a sales rep constantly travelling, this transforms a tedious chore into a two-minute task. The ability to delegate access also allows a personal assistant or accountant to manage the entire process, freeing up the traveller’s time completely.

Navigating International Travel and Multi-Currency Expenses

When your team operates across borders, your expense policy must adapt. For consultants at firms like BCG, project managers overseeing sites across Europe, or sales reps managing a global pipeline, multi-currency expenses add significant complexity. A standard domestic travel and expense policy is inadequate when dealing with fluctuating exchange rates, foreign transaction fees, and varying tax regulations.

This is not a minor inconvenience; it creates tangible problems. Manually converting a receipt from Swiss Francs (CHF) to Euros (EUR) using the precise exchange rate from a specific past date is tedious and error-prone. A small mistake can affect reimbursement amounts, disrupt an employee's personal finances, and complicate company accounting.

Setting Clear Rules for Foreign Expenses

To prevent confusion, your policy must provide direct answers to common questions about international travel. This clarity is crucial for anyone accumulating receipts in different countries, whether it's a freelance architect in Japan or a pharma representative at a conference in Singapore.

Start by establishing a single source for exchange rates. A straightforward rule could be:

- Exchange Rate Source: All foreign currency expenses will be converted to our base currency using the rate published by a specified authority (e.g., the European Central Bank) on the date of the transaction.

- Foreign Transaction Fees: The policy must state that bank or credit card fees from international business transactions are reimbursable. Employees should not bear these costs personally.

- VAT and Tax Compliance: For travel within the EU, obtaining itemised receipts with correct VAT information is essential for claiming deductions and ensuring compliance.

Providing resources and tips, such as guides on smart travel strategies like booking business class to Europe for less than coach, can also help your team manage these costs effectively.

The Problem with Manual Conversion and Reporting

Relying on manual processes for multi-currency expenses is inefficient and risky. An employee returning from a multi-country trip faces the time-consuming task of finding historical exchange rates for a stack of receipts. This process can consume hours of productive time—the classic Friday afternoon email chain with accounting that nobody enjoys.

For anyone working in a regulated industry or under Europe's strict GDPR rules, financial data accuracy and security are non-negotiable. Tracking expenses on a spreadsheet just doesn't offer the security or precision needed, opening the door to compliance risks and costly data entry mistakes.

Modern, mobile-first tools address this directly. Instead of requiring employees to perform manual currency conversions, a solution like Bill.Dock handles it automatically. With support for over 150 currencies, it instantly converts expenses using the correct rate from the transaction date, ensuring accuracy without manual effort. For companies in the DACH region and beyond, having data processed on secure, GDPR-compliant EU servers in Frankfurt is a critical requirement. You can get a better handle on these costs with our travel expense calculator.

For an individual consultant, freelancer, or small business, this approach avoids the complexity and high cost of enterprise systems like SAP Concur or Expensify, offering a direct, fast, and compliant way to manage international expenses.

Ensuring Policy Compliance with the Right Tools

A travel and expense policy is only as effective as its enforcement. Without a consistent and fair process, even the most detailed guidelines are merely suggestions. The goal is not to foster a culture of mistrust, but to create a predictable system that makes it easy for everyone—from a consultant at McKinsey to a self-employed professional—to adhere to the rules.

Effective compliance depends on a clear approval workflow. A manager's approval serves as the first line of defence, confirming an expense is legitimate and within policy. A transparent process for handling exceptions is also necessary. This may involve a conversation to understand the context of an out-of-policy expense rather than an automatic rejection.

Policies also require periodic updates. The rules created today may not be suitable in a year. Regular reviews, conducted at least annually, ensure your guidelines remain relevant to current travel costs, business needs, and new regulations.

Choosing the Right Tool for the Job

Technology is the bridge between policy and practice. The right expense management tool can automate enforcement, reduce manual work, and provide a clean audit trail. However, the market is diverse, and a solution designed for a large corporation is often unsuitable for an individual or small business.

The landscape is generally divided between two types of solutions. Understanding their differences is key to selecting the right one.

The real problem with expense reporting isn't the policy itself; it's the friction. Time wasted on manual data entry, chasing lost receipts, or trying to figure out foreign currencies is time that could be spent on actual, billable work. The right tool simply makes all that friction disappear.

Comparing Enterprise Systems and Individual-Focused Tools

On one side are comprehensive enterprise systems designed for large corporations.

- Enterprise Platforms (e.g., SAP Concur, Spendesk, Rydoo): These are powerful, integrated solutions that combine travel booking, corporate cards, and expense reporting. They are built for stringent control and deep integration with corporate finance systems. For smaller teams, freelancers, or consultants, they can be overly complex, expensive, and difficult to implement.

On the other side are nimble, mobile-first applications built for speed and simplicity.

- Individual & SMB Tools (e.g., Bill.Dock, N2F, Circula): These tools are focused on solving the immediate pain points of the end-user. They prioritise fast receipt scanning, accurate data capture, and simple report generation. They are designed for professionals who need clean records for reimbursement or tax filing without corporate bureaucracy.

Expense Management Tool Comparison

This table provides a high-level comparison of these tool categories.

| Tool Type | Best For | Common Examples | Key Strengths |

|---|---|---|---|

| Enterprise Systems | Large corporations needing integrated procurement and deep IT control. | SAP Concur, Spendesk, Rydoo | All-in-one platform, advanced policy controls, deep ERP links. |

| Individual & SMB | Freelancers, consultants, small businesses, and frequent business travellers. | Bill.Dock, N2F, Circula | Speed, mobile-first design, ease of use, affordable pricing. |

The "best" tool depends on the scale and complexity of your needs.

A Simpler Approach for Modern Professionals

For many professionals, the pain points are universal: lost receipts, tedious data entry, and the difficulty of getting expenses to an assistant or accountant. A tool like Bill.Dock was built to solve these specific problems. With AI receipt scanning that provides 95%+ accuracy, it eliminates the chore of manually typing up expenses. A user can simply take a photo on their iOS or Android device to capture the data.

This mobile-first approach is ideal for the frequent traveller. The multi-currency support for over 150+ currencies automatically handles conversions, a significant advantage for international work. Critically, the delegate access feature allows secure sharing with a personal assistant or accountant, who can then manage, categorise, and export everything to Excel, CSV, or PDF.

With plans starting at €59/year, Bill.Dock offers a focused, high-value solution without the complexity of enterprise software. This is particularly important for those requiring GDPR compliance and EU-based data servers in Frankfurt. You can learn more about the benefits of digitisation in our guide to paperless accounting software.

Ultimately, the right tool makes compliance the path of least resistance.

Answering Your Top T&E Policy Questions

Here are practical answers to some of the most common questions that arise once a policy is implemented.

How Often Should We Review Our Travel and Expense Policy?

A T&E policy should be treated as a living document and reviewed at least annually.

A review should also be triggered by significant changes, such as expansion into a new country, a sharp increase in travel costs, or recurring questions about a specific rule. A static policy quickly becomes outdated; a per diem rate set three years ago is unlikely to be adequate in London or Singapore today.

How Do We Handle Expenses Paid with Personal Versus Corporate Cards?

The policy must clearly differentiate between the two. For corporate cards, specify that they are for business use only and detail the reconciliation process.

For personal cards, clearly define what is reimbursable and the submission process, including the required proof of payment. The objective is to reimburse employees promptly so they are not personally financing company expenses.

A core principle of a fair travel and expense policy is that employees should never be out-of-pocket for legitimate business costs. Swift reimbursement for personal card use is essential for maintaining trust and morale.

What’s the Procedure for a Lost Receipt?

Mistakes happen. Your policy needs a clear backup plan. Typically, this involves the employee completing a "missing receipt affidavit" or a similar form, detailing the vendor, date, amount, and business purpose of the expense.

Many companies set a limit (e.g., £25) for claims without a receipt and may cap the number of such claims per year. However, prevention is the best approach. Using a mobile app to capture a photo of the receipt immediately eliminates the risk of lost or faded documents.

How Should Our Policy Address Expenses for Remote Workers?

For remote teams, the policy should focus on home office support rather than travel. This could include a stipend for internet service, reimbursement for office supplies, or an allowance for ergonomic equipment.

Clarity is key. Define what is covered, the spending limits, and the required documentation to ensure tax compliance and mutual understanding between the company and the employee.

Stop wasting time on manual expense reports and chasing faded receipts. Bill.Dock uses AI to capture receipt data with over 95% accuracy, supports 150+ currencies, and allows you to delegate access to your assistant or accountant. Available on Web, iOS, and Android. Start your free 30-day trial today—no credit card required. Find out more at Bill.Dock.

Authored using Outrank app